Table of Contents

ToggleThere’s nothing more crucial than having your W2 form in hand when tax season hits. Losing or not receiving this important document from an old job can cause major headaches. In this blog post, I’m going to walk you through the steps to get your hands on that W2 from a previous employer, ensuring you are ready to tackle tax season like a boss.

Key Takeaways:

- Contact the HR department: Reach out to the human resources department of your old job to request a copy of your W2.

- Check online portals: Some companies provide access to past W2 forms through online portals, so make sure to look there first.

- Request by mail: If you can’t find your W2 online, you can ask the company to send you a physical copy by mail.

- Use tax software: If all else fails, you can input your information into tax software, which can help generate a substitute W2 form.

- Reach out to the IRS: If you still can’t obtain your W2, you can contact the IRS for assistance in obtaining the information you need to file your taxes.

- Keep records: Make sure to keep copies of all correspondence with your old job and the IRS in case you need to reference them later.

- Plan ahead: To avoid this situation in the future, make sure to keep track of all your important tax documents and store them in a safe place.

The Power of Preparation: Laying the Groundwork

Tips for Organizing Your Employment History: Tracking Down the Old Job

Tips for tracking down that elusive W2 from an old job start with organizing your employment history. Make a list of all the companies you’ve worked for, including dates of employment, company names, and contact information. Be sure to include any freelance or contract work as well.

- Keep detailed records of all your previous jobs.

- Contact each employer directly if you have trouble locating your W2.

Assume that the process of retrieving your W2 may take some time, so be prepared to be patient and persistent.

Factors That Affect the W2 Retrieval Process: Knowing What You’re Up Against

Power through the obstacles that may arise when trying to retrieve your old W2 forms. Understand that factors such as company closures, mergers, or acquisitions can complicate the process. Additionally, changes in payroll providers or HR departments may also impact your ability to get your hands on that crucial form.

- Be prepared for delays due to changes in company structure.

- Stay persistent in your efforts to obtain your W2, no matter the obstacles.

Assume that the more proactive and organized you are in your approach, the smoother the process will be, regardless of the challenges you may face.

The journey to retrieving your old W2 forms may be riddled with hurdles, but with the right mindset and approach, you can overcome them. Stay focused on your end goal and be prepared to navigate through any unexpected twists and turns. Be mindful of, preparation and persistence are key in successfully obtaining the documents you need to file your taxes accurately and on time.

Also Read : How To Decline A Job Offer

Forging Ahead: Contacting Your Previous Employer

Now, if you’re looking to get a copy of your W-2 from an old job, the first step is to reach out to your previous employer directly. Many companies use third-party payroll services like ADP to handle tax forms. If that’s the case, you may need to fill out a request form to get a copy of your W-2. For detailed guidance on navigating this process, check out the Form W-2 and Form 1099 Guide for Employees.

Also Read : How To Make Money Without A Job

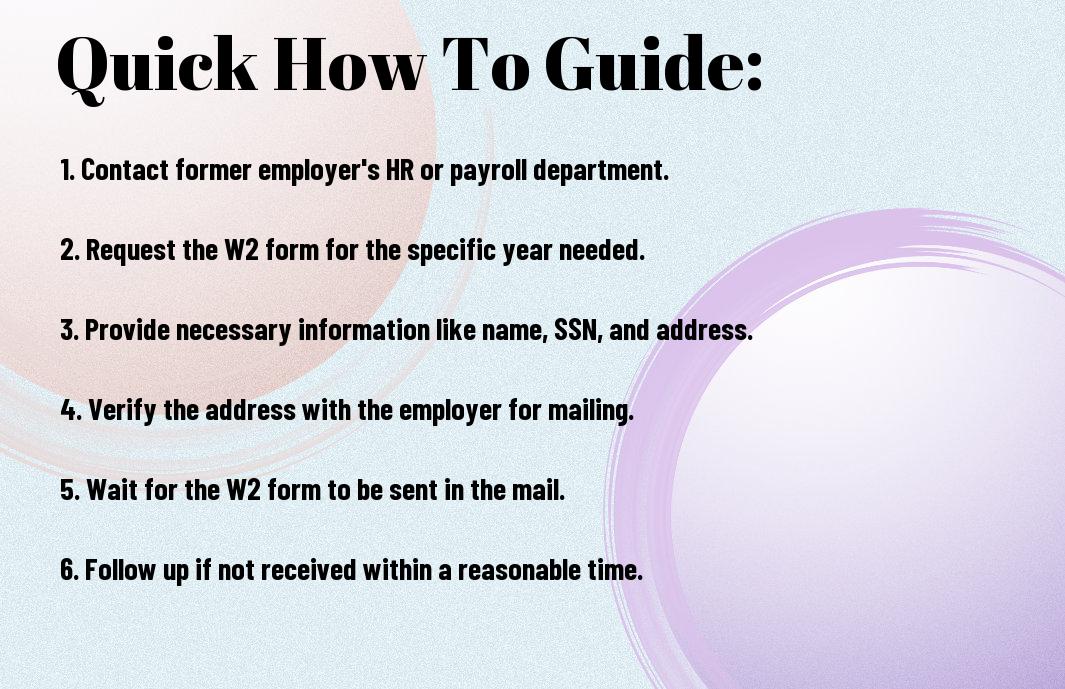

The Direct Approach: How-to Reach Out the Right Way

For some individuals, contacting HR or the payroll department at your previous employer may be enough to obtain a copy of your W-2. Be polite and provide all necessary information such as your full name, social security number, and the year of the W-2 you are requesting. Note, a little kindness can go a long way in getting the assistance you need efficiently.

Alternatively, if you are unable to get the help you need from HR or the payroll department, you can try reaching out to other contacts within the company. Former colleagues or supervisors may have insights or connections that could help you obtain the necessary documentation.

Alternative Tactics When HR Isn’t Helping: Next-Level Strategies

For those facing obstacles in obtaining their W-2 form from a previous employer, there are alternative strategies that can be employed. One effective method is to contact the IRS directly. They can provide you with information on how to file your taxes without a W-2, ensuring you meet your tax obligations accurately and on time.

Plus, you can also consider seeking assistance from a tax professional or accountant. These experts are well-equipped to handle complex tax situations and can guide you through the process of obtaining the necessary documentation from your old employer. Don’t hesitate to leverage their knowledge and experience to navigate this challenge effectively.

Also Read : How To Find A Job

Navigating Government Channels: The IRS Connection

Once again, if you’re looking to obtain an old W2 form from a previous employer, one of the most direct routes is through the Internal Revenue Service (IRS). The IRS maintains a record of the information reported on your W2 forms, making it a valuable resource in obtaining a copy of a past W2.

Leveraging Taxpayer Resources: How to Request Transcripts or Copies

To access your old W2 information through the IRS, you can request a Wage and Income Transcript or an actual copy of your W2. The Wage and Income Transcript shows data from information returns the IRS receives, such as W2s and 1099s. You can order these transcripts online, by phone, or by mail. If you need an actual copy of your W2, you will need to fill out Form 4506 and mail it to the IRS along with a fee.

Protecting Your Identity: Tips for Handling Sensitive Information

Handling your sensitive information during this process is crucial to safeguarding your identity. When requesting transcripts or copies of your W2, never share personal details over unsecured channels. Avoid sending sensitive information through email or providing it over the phone unless you are certain of the recipient’s identity.

- Be cautious when sharing personal information.

- Use secure methods to transmit sensitive data.

- Keep records of all interactions for reference.

Handling your sensitive information with care is not just a one-time task – it’s an ongoing practice to prevent identity theft and fraud. After obtaining your old W2, ensure that you store it securely and dispose of any unnecessary copies properly to reduce the risk of exposure.

- Regularly monitor your accounts and credit reports for any suspicious activity.

- Shred any documents containing sensitive information before discarding them.

- Keep your personal information confidential and only share it when necessary.

Transcripts and copies of your old W2 forms contain valuable details that can help you in various financial and tax-related situations. By following the proper procedures and safeguarding your sensitive information, you can navigate the IRS channels smoothly and protect yourself from potential risks.

Also Read : How To Respectfully Decline A Job Offer

Technical Savvy: Using Digital Resources to Your Advantage

Platforms and Portals: How-to Guide for Online W2 Recovery

One of the most effective ways to retrieve your W2 from an old job is by leveraging online platforms and portals. Many companies now provide access to past tax documents through their employee portals or designated websites. To get started, you’ll need to log in to the portal using your old employee credentials. Once logged in, look for a section labeled “Tax Documents,” “W2 Forms,” or something similar. From there, you should be able to view and download your past W2 forms with ease.

Another option is to use third-party platforms like TurboTax or H&R Block, which offer services for retrieving past tax documents, including W2 forms. Simply create an account on these platforms, follow the prompts to import your information using details from your old job, and voila – your W2 should be accessible for download.

Email Etiquette: Crafting the Perfect Request for Documents

Assuming you can’t access your old job’s online portal or you’re no longer in touch with former colleagues, sending an email requesting your old W2 is a smart move. When crafting your email, be sure to keep it professional and concise. Start by addressing the recipient in a polite manner and clearly stating the purpose of your email – to request a copy of your past W2 form. Include any relevant details such as your full name, the year of the W2 you’re seeking, and your contact information for verification purposes.

It’s crucial to remember that privacy and security are necessary when sharing personal information via email. Avoid sending sensitive details like your social security number in the initial request. Instead, wait for a response from the company or individual and verify their identity before sharing any confidential information.

Also Read : How To Get A Job

Dealing with Roadblocks: When Things Don’t Go According to Plan

After navigating the process of obtaining your W2 from an old job, you may encounter roadblocks along the way. Dealing with unexpected challenges is a common occurrence, but how you handle them can make all the difference in achieving your goal. Here are some tips for staying resilient in the face of adversity.

Anticipating Challenges: How-to Stay Cool When Pressure Rises

One of the best ways to prepare for challenges is to anticipate them before they arise. By expecting the unexpected, you can avoid being caught off guard and maintain a level head when faced with obstacles. Remember to take a deep breath and remind yourself that setbacks are temporary. Focus on finding solutions rather than dwelling on the problem, and don’t be afraid to ask for help if you need it.

Creative Problem Solving: Tips for Unorthodox Situations

Rises above the challenges by thinking outside the box and embracing creative problem-solving techniques. When traditional methods don’t work, it’s time to get inventive and explore new approaches. Utilize your creativity and resourcefulness to find alternative paths towards your goal. Don’t be afraid to take risks and try unconventional strategies – sometimes the most unorthodox solutions yield the best results.

- Think outside the box and explore new approaches.

- Utilize your creativity and resourcefulness.

- Don’t be afraid to take risks and try unconventional strategies.

- Embrace the opportunity to learn and grow from any setbacks.

Situations that appear impossible at first glance can often be overcome with a little ingenuity and perseverance. Note, every roadblock is a chance to prove your resilience and determination. Stay focused on your end goal and don’t let setbacks derail your progress. With a positive attitude and a willingness to adapt, you can conquer any challenge that comes your way.

The Legal Landscape: Understanding Your Rights and Remedies

Keep in mind that when it comes to obtaining your W2 from an old job, there are legal avenues you can pursue to ensure you receive the documentation you need. Familiarizing yourself with the legal landscape can empower you to take action and protect your rights as an employee.

Factors Affecting Legal Recourse: What’s in Your Control

- Employment laws in your state

- The terms of your employment contract

Even though the situation may seem out of your hands, there are factors that you can control to increase your chances of obtaining your W2 form. By understanding the employment laws in your state and reviewing your employment contract, you can determine your rights and the proper steps to take in this situation. After all, knowledge is power when it comes to legal matters.

Navigating Bureaucracy: Tips for Using Policy to Your Advantage

- Communicate with HR or your former employer

- Submit a formal written request

Navigating bureaucracy can be a frustrating process, but when it comes to obtaining your W2, following the policies in place can work to your advantage. By proactively communicating with HR or your former employer and submitting a formal written request, you are demonstrating your commitment to resolving the issue in a professional manner. This proactive approach can expedite the process and ensure you receive the necessary documentation. This is your chance to take the reins and steer the situation in your favor.

Also Read: How To Make Money Without A Job

Final Words

With this in mind, make sure to reach out to your old employer and request a copy of your W-2 form. It’s important to stay persistent and follow up if necessary to ensure you receive the necessary documentation. Keep in mind, taking control of your financial records is crucial for future tax purposes.

Don’t be afraid to advocate for yourself and communicate clearly with your previous employer about your need for the W-2 form. Stay organized and proactive in gathering all the necessary paperwork to stay on top of your tax responsibilities. Keep in mind, knowledge is power, and being well-informed about how to obtain your W-2 can save you from headaches down the road!

FAQ

Q: How can I get a W2 from an old job?

A: It’s easy peasy! Just reach out to your old employer. They are required by law to provide you with a copy of your W2. If you are having trouble contacting them, try reaching out to their HR department or payroll services.

Q: Is there a deadline for employers to provide W2s?

A: Yes, employers must provide W2s to their employees by January 31st of each year. If you haven’t received yours by then, don’t hesitate to follow up with your former employer.

Q: What if my old employer has gone out of business?

A: No worries! You can contact the IRS for assistance. They can help you obtain the information you need to file your taxes, even if your previous employer is no longer in operation.

Q: Can I get a digital copy of my W2?

A: Absolutely! Many employers offer online portals where you can access and download your W2. Check with your old employer to see if this option is available to you.

Q: What should I do if there is an error on my W2?

A: Mistakes happen! If you spot an error on your W2, reach out to your former employer to get it corrected as soon as possible. It’s important to have accurate information when filing your taxes.