Table of Contents

ToggleGet W2 From Old Job Just landed a new gig and need your W2 from your old job? Don’t sweat it – I’ve got your back! Whether you left on great terms or things ended on a sour note, getting your hands on that crucial piece of paper is key to getting your taxes filed on time. Follow these steps, and you’ll have that W2 in no time, ready to tackle your taxes like a pro.

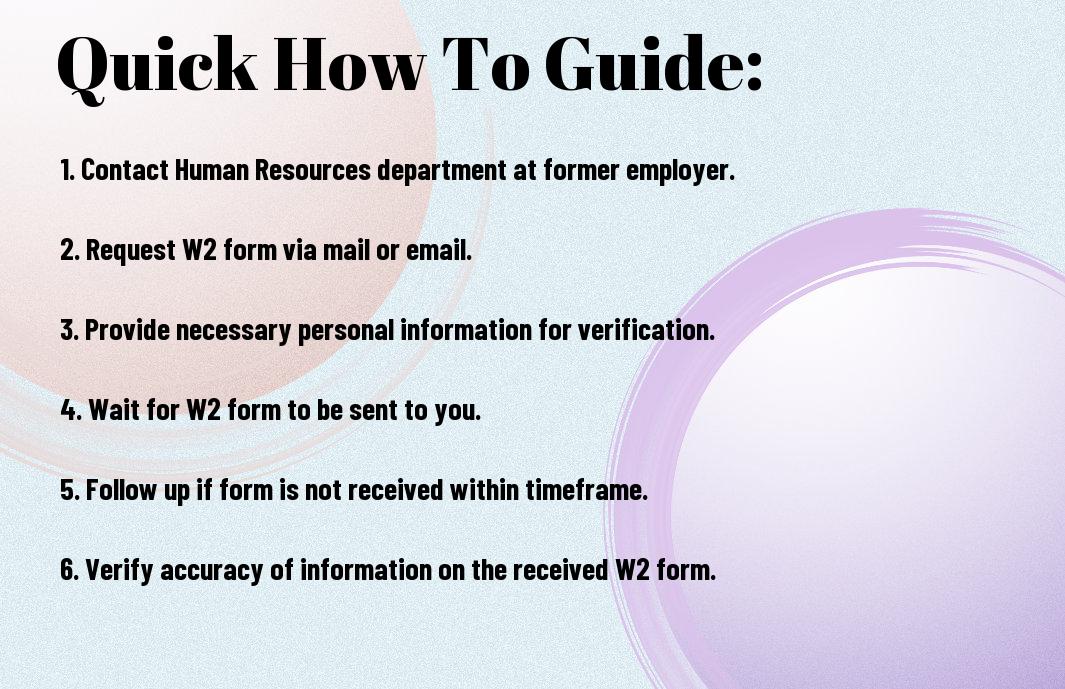

Key Takeaways: Get W2 From Old Job

- Contact HR: Reach out to the Human Resources department of your old job to request a copy of your W2.

- Provide Information: Be prepared to provide necessary information such as your full name, social security number, and the year for which you need the W2.

- Request in Writing: Send a formal written request via email or mail to ensure there is a paper trail for your request.

- Wait for Processing: Give the company some time to process your request and send you the copy of your W2.

- Consider Tax Software: If you are unable to get the W2 from your old job, consider using tax software that can help you retrieve the necessary information.

- IRS Assistance: If all else fails, you can reach out to the IRS for assistance in obtaining your W2 from a previous employer.

- Keep Records: Keep a record of all communications and follow-ups related to your request for the W2 to ensure you have a backup plan if needed.

Setting the Stage: What is a W2 and Why Do You Need It?

There’s a common document that plays a significant role in your financial life, especially come tax season – the W2 form. But what exactly is a W2, and why is it so crucial to have in your possession? Well, think of your W2 as a snapshot of your earnings and taxes withheld from your employment over the past year. This form is provided by your employer and outlines important details such as your total wages, federal and state taxes withheld, and any contributions made to retirement accounts.

Breaking Down the W2: The Basics

Little did you know, your W2 is not just a piece of paper but a key to unlocking important financial information. It’s crucial for filing your tax returns accurately and ensuring you don’t overpay or underpay the IRS. Understanding each section of the W2, from Box 1 showing your total wages to Box 2 reflecting federal income tax withheld, empowers you to take control of your finances and plan strategically for the year ahead.

Bear in mind, your W2 isn’t just about taxes; it also serves as a proof of income when you apply for loans, mortgages, or rental agreements. Keeping track of your W2 forms from previous years can help you track your career progression and financial stability over time.

The Long-Term Play: How Your W2 Affects Your Financial Health

Financial stability isn’t just about making money; it’s about managing it wisely. Your W2 plays a significant role in this game by detailing your annual earnings and tax contributions. By analyzing your W2 each year, you can identify trends in your income, evaluate your tax liabilities, and make informed decisions about saving, investing, or budgeting for the future.

Plus, understanding the impact of deductions, credits, and exemptions listed on your W2 can help you maximize your tax refund or minimize what you owe. Being proactive about reviewing and utilizing your W2 can potentially save you thousands of dollars in the long run and set you up for a more secure financial future.

Also Read : How To Get A Job

The Initial Move: Contacting Your Old Employer

Now is the time to take action and reach out to your old employer to request your W2 form. Crafting the perfect W2 request is crucial to ensure you receive the necessary information in a timely manner. Be strategic in your approach to get the results you desire.

Crafting the Perfect W2 Request: Tips & Scripts

- Be polite and professional: When reaching out to your old employer, always maintain a respectful tone in your communication.

- Provide necessary details: Make sure to include your full name, employee ID, and the year for which you need the W2 form.

- Follow up: If you don’t hear back within a reasonable timeframe, send a gentle reminder to ensure your request is being processed.

Perfect your W2 request by following these strategies to guarantee a smooth process. Bear in mind, persistence is key when it comes to obtaining important documents from past employers.

Plan B: What To Do If Your Employer Is MIA

Any experienced individual will tell you that not all employers are prompt in responding to requests, including W2 forms. In the event that your old employer is missing in action, you must have a backup plan in place.

To tackle this situation head-on, consider reaching out to the human resources department or a former colleague who may have access to the necessary information. Sometimes, a personal connection can expedite the process and help you get the W2 form you need quickly. Bear in mind, where there’s a will, there’s a way!

Also Read : How To Respectfully Decline A Job Offer

Going Digital: Online Platforms and Payroll Services

Navigating Online Portals: A Step-By-Step Guide

If you’re looking to retrieve your W2 form from an old job, navigating online portals is the way to go. Many companies offer employees access to online platforms where they can easily view and download important tax documents. Here’s a step-by-step guide to help you retrieve your W2 form hassle-free:

| Step 1 | Login to the employee portal |

| Step 2 | Locate the tax documents section |

| Step 3 | Download your W2 form |

Leveraging Payroll Service Providers for Your Gain

Online payroll service providers can be a game-changer when it comes to accessing old W2 forms. These platforms are designed to streamline payroll processes and make it easier for both employers and employees to access important tax documents. By leveraging these services, you can gain quick and easy access to your W2 forms whenever you need them.

Gain access to your W2 forms with just a few clicks, eliminating the hassle of waiting for paper documents to arrive in the mail. Additionally, online payroll service providers often offer secure storage for your tax documents, giving you peace of mind knowing your information is protected.

Also Read : How To Find A Job

The Legal Framework: Knowing Your Rights and Deadlines

The Power of Knowledge: Understanding the IRS Guidelines

Not being aware of the IRS guidelines can put you at a serious disadvantage when trying to obtain your W2 from an old job. Understanding the rules and regulations set forth by the IRS can empower you to navigate the process with confidence and efficiency. By familiarizing yourself with these guidelines, you can ensure that you are taking the necessary steps to secure your W2 in a timely manner.

Knowing the IRS guidelines can help you avoid unnecessary delays or complications in getting your W2. Make sure you are aware of the requirements for employers to provide W2 forms to employees by a specific deadline. Familiarize yourself with the proper channels for requesting a copy of your W2 if you have not received it from your old job. Being informed will give you the upper hand in resolving any issues that may arise.

Timing is Everything: Legal Deadlines for W2 Distribution

One of the most crucial aspects of obtaining your W2 from an old job is understanding the legal deadlines set forth by the IRS. Employers are required to distribute W2 forms to their employees by January 31st of each year. This deadline ensures that individuals have ample time to file their tax returns accurately and on time. If you have not received your W2 by this date, it is important to take immediate action to request a copy from your employer.

Timing is of the essence when it comes to W2 distribution. Waiting too long to pursue your W2 from an old job can result in penalties or delays in filing your taxes. Be proactive and reach out to your former employer as soon as possible to ensure that you have the necessary documentation to complete your tax return.

Also Read : How To Make Money Without A Job

Alternative Strategies: When the Traditional Route Fails

Network Hustle: How Connections Can Help You Retrieve Your W2

Once again, you find yourself in a bind trying to track down your elusive W2 from an old job. When the traditional methods fail, it’s time to get creative and tap into the power of your network. An often overlooked strategy is reaching out to former colleagues or contacts at the company where you worked. They may have access to resources or contacts that can help expedite the process of retrieving your W2.

Don’t be afraid to leverage social media platforms like LinkedIn to connect with individuals who may be able to assist you. Networking is key in situations like these, and you never know who in your extended network might have the key to unlocking your W2.

The IRS and You: Requesting Your W2 Directly from the Source

Strategies can sometimes fail, and when that happens, it’s time to go straight to the source. The IRS can be a valuable resource in helping you obtain a copy of your missing W2. By filling out Form 4506-T, you can request a transcript of your W2 directly from the IRS. This process may take some time, so be prepared to wait for the information to be processed and delivered to you.

From contacting former colleagues to reaching out to the IRS, there are alternative strategies you can employ when the traditional route fails to get your W2 from an old job. No matter the method you choose, persistence and resourcefulness are key in overcoming this obstacle. Keep in mind, where there’s a will, there’s always a way to get what you need.

Also Read : How To Decline A Job Offer

Avoiding the Trap: How to Ensure You Get Your W2 on Time Every Time

Unlike other documents you may receive from your old job, your W2 form is crucial for filing your taxes. Missing or delayed W2 forms can cause major headaches with the IRS, so it’s crucial to ensure you receive yours on time, every time. To avoid the stress and frustration that can come with missing W2 forms, follow these tips to set up a system that guarantees you receive your W2 promptly.

Pro Tips: Setting Up the System for Next Year

- Keep your contact information updated with your old employer to avoid any communication issues.

- Set a reminder in your calendar for the time of year when W2 forms are typically distributed to stay proactive.

After implementing these strategies, you can rest assured that you’ll be prepared when tax season rolls around.

Factors to Consider: Making Sure You’re in Control

- Ensure that your employer has your correct mailing address to receive your W2 without delays.

- Double-check with your employer that they have your updated email address to send electronic copies of the W2.

Knowing that you have control over the delivery of your W2 forms can alleviate any worries about missing crucial tax documents.

For instance, making sure your employer has accurate information is key to receiving your W2 on time. Having the right details on file can prevent delays or miscommunications that could impact your tax filing process. Take charge of your information to secure a smooth tax season.

- Regularly review your contact information with your employer to guarantee accurate delivery of important documents.

- Know the deadlines for when W2 forms are typically distributed to anticipate its arrival.

Knowing that you have control over these factors can ensure a stress-free tax season.

To wrap up

As a reminder, getting your W2 from an old job is not as complicated as it seems. Make sure to reach out to your former employer or check online resources for access to your past tax information. Note, staying organized and proactive about your financial documents will benefit you in the long run. Hustle hard and get what you need to stay on top of your game!

Also Read : How To Write A Cover Letter For A Job

FAQs

Q: How can I get my W2 from my old job?

A: The first step is to reach out directly to your previous employer’s HR department. If you don’t have any luck there, you can also contact the IRS for assistance in obtaining a copy of your W2.

Q: What information will I need to provide when requesting my old W2?

A: You’ll likely need to provide your full name, address, Social Security number, and the year for which you are requesting the W2 form. Make sure to have this information ready to speed up the process.

Q: Can I get a copy of my old W2 online?

A: Some employers provide access to past W2 forms through their online payroll portals. Check with your former employer to see if this option is available to you.

Q: What should I do if I can’t get a copy of my old W2?

A: If you’ve exhausted all options and still can’t get a copy of your old W2, you can file Form 4852 with the IRS as a substitute for the missing form. Be sure to estimate your earnings and taxes withheld as accurately as possible.

Q: Is there a deadline for obtaining my old W2?

A: The deadline for requesting a copy of your old W2 from your employer is typically January 31st. If you haven’t received it by then, take action immediately to ensure you meet tax filing deadlines.